To find the standard cost, we add the standard labor cost, the standard materials cost, and the standard overhead cost. Variances from this could be favorable if they resulted in a cheaper final product or unfavorable if they cost the company more. Material variance is the difference between the actual cost of direct materials and the expected cost free electronic filing for individuals of those materials. Sharing variance reports and findings with relevant departments fosters a collaborative environment where everyone is aware of cost control objectives. For instance, procurement teams can work closely with suppliers to negotiate better prices, while production teams can implement process improvements to reduce material waste.

What is your current financial priority?

The actual quantity (1,200 sheets) of plastic is removed from the raw materials inventory at the standard price (4.00) giving a credit entry of 4,800 posted to the account. The standard quantity (1,000) which should have been used in production is transferred to work in process inventory at the standard price (4.00), giving a total debit entry of 4,000. The difference between the two postings is the variance of -800, which is posted to the direct materials variance account as a debit representing the unfavorable variance. The difference in the quantity is multiplied by the standard price to determine that there was a $1,200 favorable direct materials quantity variance.

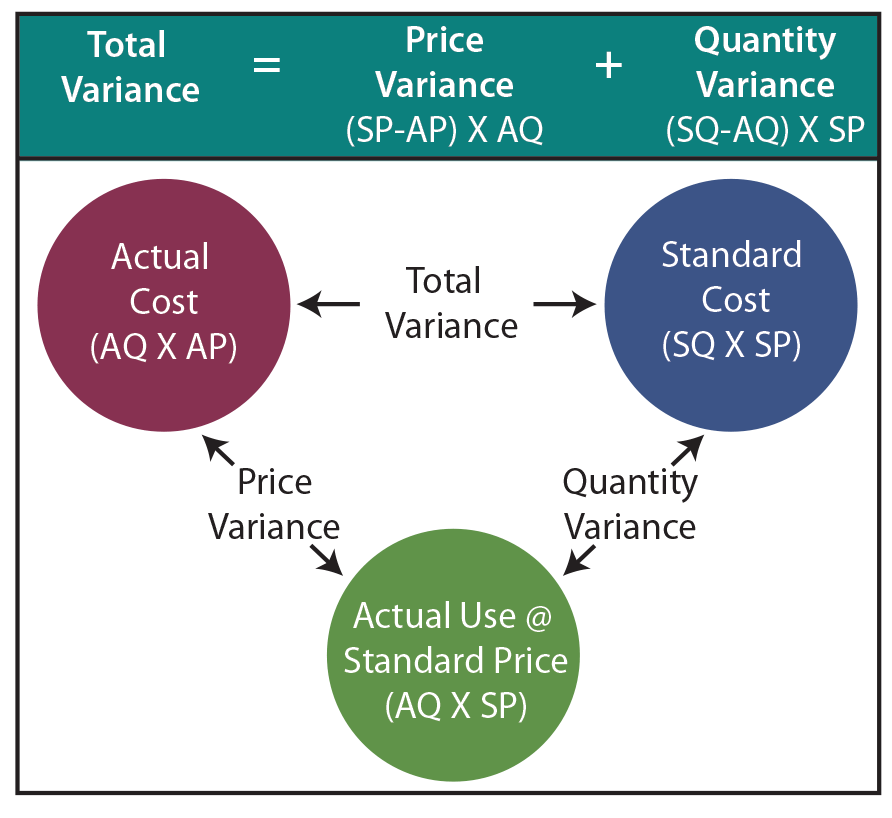

Diagramming direct materials variances

However, the initial calculation provides a broad overview that can guide more detailed analysis. By regularly monitoring these variances, businesses can quickly identify trends or anomalies that may indicate underlying issues, such as supplier problems or inefficiencies in the production process. $10 times 1000 units creates a $10,000 unfavorable variance for labor, since it costs you more money.

Question 1

Additionally the variance is sometimes referred to as the direct materials usage variance or the direct materials efficiency variance. It is usually better to compute the variance when materials are purchased because that is when the purchasing manager, who has responsibility for this variance, has completed his or her work. In addition, recognizing the price variance when materials are purchased allows the company to carry its raw materials in the inventory accounts at standard cost, which greatly simplifies bookkeeping. The material price variance calculation tells managers how much money was spent or saved, but it doesn’t tell them why the variance happened. One common reason for unfavorable price variances is a price change from the vendor. Companies typically try to lock in a standard price per unit for raw materials, but sometimes suppliers raise prices due to inflation, a shortage or increasing business costs.

Direct Material Price Variance

The net direct materials cost variance is still $1,320 (unfavorable), but this additional analysis shows how the quantity and price differences contributed to the overall variance. Because the company uses 30,000 pounds of paper rather than the 28,000-pound standard, it loses an additional $20,700. Like direct materials price variance, this variance may be favorable or unfavorable. If workers manufacture a certain number of units using a quantity of materials that is less than the quantity allowed by standards for that number of units, the variance is known as favorable direct materials quantity variance. On the other hand, if workers use the quantity that is more than the quantity allowed by standards, the variance is known as unfavorable direct materials quantity variance.

Example: How to Calculate Direct Materials Quantity Variance

You can check this video of mine for more examples of the material quantity variance. Now that we know the standard quantity, we can use the DMQV formula to calculate the variance. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The MQV should be favorable because the standard quantity of the fabric for making 10,000 shirts is 28,000 meters which is less than what was actually used (30,000 meters).

The standard price of materials purchased by Angro is $2.00 per kg and standard quantity of materials allowed to produce a unit of product is 1.5kg. Calculate direct materials quantity variance and also indicate whether it is favorable or unfavorable. Direct materials quantity variance is a part of the overall materials cost variance that occurs due to the difference between the actual quantity of direct materials used and the standard quantity allowed for the output. Generally, the production managers are considered responsible for direct materials quantity variance because they are the persons responsible for keeping a check on excessive usage of production inputs. However, purchase managers may purchase low quality, substandard or otherwise unfit materials with an intention to improve direct materials price variance.

- Specifically, knowing the amount and direction of the difference for each can help them take targeted measures forimprovement.

- However, purchase managers may purchase low quality, substandard or otherwise unfit materials with an intention to improve direct materials price variance.

- If there wasn’t enough supply available of the necessary raw materials, the company purchasing agent may have been forced to buy a more expensive alternative.

- During the month of December 2022, its workers used 3,750 feet of timber to finish 1,500 office chairs.

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know.

Total actual and standard direct materials costs are calculated by multiplying quantity by price, and the results are shown in the last row of the first two columns. When complete, capitalizable variances should be recorded in a “standard-to-actual” reserve within inventory on the balance sheet with the remainder being appropriately expensed through the income statement. This reserve has the effect of adjusting the company’s inventory balances to “actual,” which is appropriate under GAAP. On a net basis, the purchase price variance is really the difference between standard cost of the material and the actual invoice price of the material.